The Economics of Dosa

Inflation barrages on the purchasing power of an individual. This necessarily means that now, an individual is in a position to buy lesser amount of a particular good with the same amount of money.

As a very high rate of inflation is undesirable for an economy, the central bank of the country, in case of India, The Reserve Bank of India takes the charge to maintain it. Monetary policies are put to use for the same. The Central bank increases interest rates. A higher interest rate makes borrowing more expensive and saving more attractive. This leads to a lower growth in consumer spending and investment. Reduced Consumption and Reduced Investment leads to a lower economic growth which slashes down the inflation.

But, even a high inflation affects all the stakeholders in an economy differently. In case of people who have invested their money, inflation means an increase in the price of their assets. In case of people who hold money as cash, inflation scales down the power of the money they hold as it now is capable to get them lesser quantity of the same good with the same amount of money

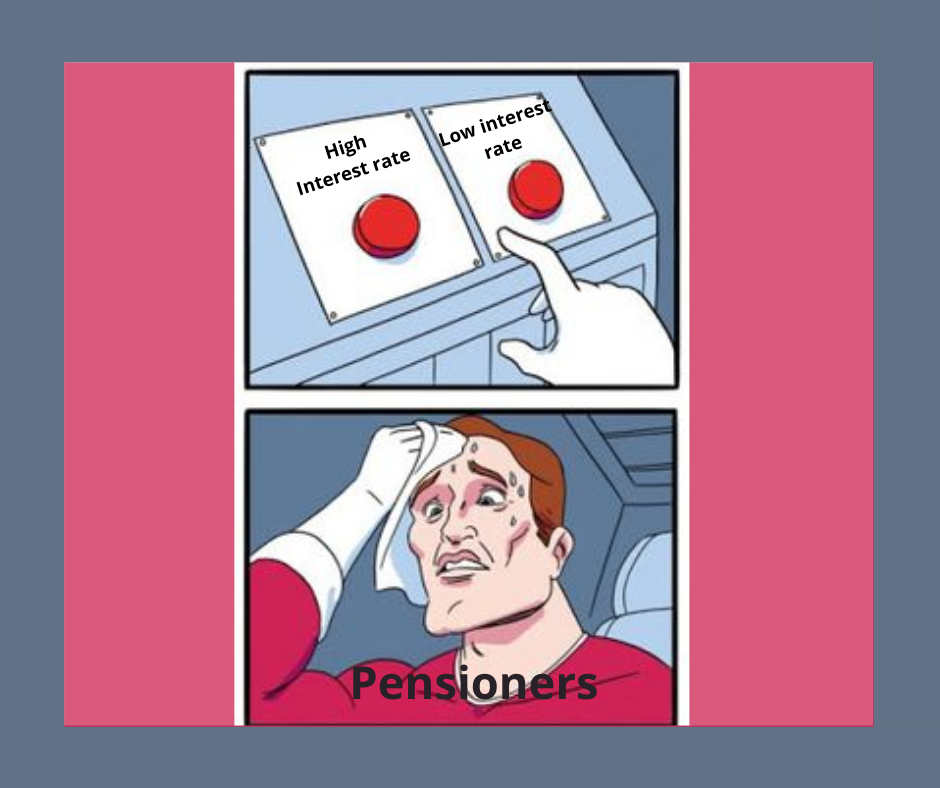

The stakeholders in the Dosa Economics Model presented by Dr Raghuram Rajan were particularly the pensioners, who resented the lower interest rate as they believed that lower interest rate means reduced savings for them. Lower interest rates affects pension funds and insurance companies on both the asset and the liability sides of their business. It increase the liabilities of pension funds and insurance companies and it would reduce future investment returns. Due to this, the solvency status of insurers and pension funds fails to improve. Low interest rate impacts the pension funds and insurance companies by affecting re-investment returns on their fixed-income portfolio. If low interest rates are expected to continue for a longer duration, lower interest income will impact insurers with long-term liabilities and shorter-term assets. Therefore, pension funds offering benefit promises and life insurance companies that sold products with high-return guarantees will not be able to fulfill those promises. Therefore, the lower interest rate axes down the pension pay-outs for the pensioners.

The Dosa Economics Model or the Dosanomics model clears the air surrounding this situation. It explains how the rise in the interest rate is merely nominal and not real, and how high inflation eats out the investment gradually leaving the pensioners worse off than before. Let’s understand this model with the help of a simple Case study.

Savings of the pensioner: INR 1,00,000

Cost of a Dosa = INR 50

No. of Dosas he can buy = 1,00,000/50 = 2000

Now let’s assume, the pensioner invested his savings for a period of one year and examine the two different cases.

CASE 1 – High Inflation and High Interest Rate

Inflation rate – 10%

Interest rate – 10%

Cost of a Dosa (after inflation) = INR 55

Savings of pensioner (adding 10% of interest rate) = INR 1, 00,000 + INR 10,000 = INR 1, 10,000

No. of Dosas he can buy = 1,10,000/55 = 2000

CASE 2 – Low Inflation and Low Interest Rate

Inflation rate – 5%

Interest Rate – 8%

Cost of a Dosa (after inflation) = INR 52.5

Savings of pensioner (adding 8% of interest rate) = INR 1,00,000 + INR 8000 = INR 1,08,000

No. of Dosas he can buy = 1,08,000/52.5 = 2058

The above case study clearly states that the pensioner is better off at a lower interest rate and low inflation as he can buy 2058 units of Dosa compared to 2000 units of Dosa at higher interest rate and high inflation. This proves that a high inflation truncates down the principal amount, while leaving the pensioners with an illusion of good returns due to higher interest rates, which are merely nominal, not real. Therefore, the low interest rates leads to a subsequent rise in the purchasing power of the pensioner, eliminating their problems!

This is the Dosanomics model, quite fulfilling, isn’t it?

VIRENDRA KUMAR

nicely explained Tanay